OUR SERVICES

Power Purchase Agreements (PPAs)

& Price hedges

GNERA Energía offers and advises its customers on the quotation of price hedges and the contracting of positions in the futures markets (OMIP) that minimise the volatility of market prices and stabilise the income from the sale of the energy generated by its power plants.

In general terms, a PPA (Power Purchase Agreement) is a contract between a consumer and a power producer, or between a producer and a trader to sell/buy electricity at a pre-set price, under agreed conditions and for a pre-set period of time.

What aspects do we negotiate in a PPA?

Counterparties

It is an agreement between the producer as seller and the Consumer or trader as buying counterparty.

Prices

A Fixed or Variable Price can be structured with Floor or Cap and Floor mechanisms.

Duration

Usually between 5-15 years. This period may be fixed or extensions may be considered depending on certain conditions.

Volume

- Base load

- Generation / consumption curve

- Agreed profile

Types

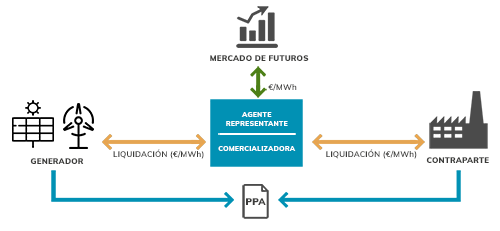

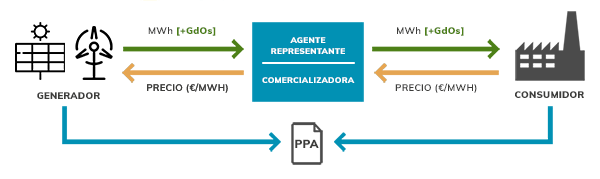

Physical or financial / synthetic.

These are contracts in which a purchase price is established for the purchase and sale of electricity in the long term and in which there is direct or indirect physical delivery of electricity.

They are contracts in which the physical delivery of energy is not considered, but consist of the financial coverage of the price of energy in the long term for a given load and in which the differences between the agreed price and the underlying price (OMIE price) are adjusted.